New Report: ‘Medicare At 60’ Could Come with Large Price Tag, Higher Costs For Americans

WASHINGTON – As some policymakers discuss proposals to lower the Medicare eligibility age, such as “Medicare at 60,” a new report shows there could be unaffordable costs and negative consequences.

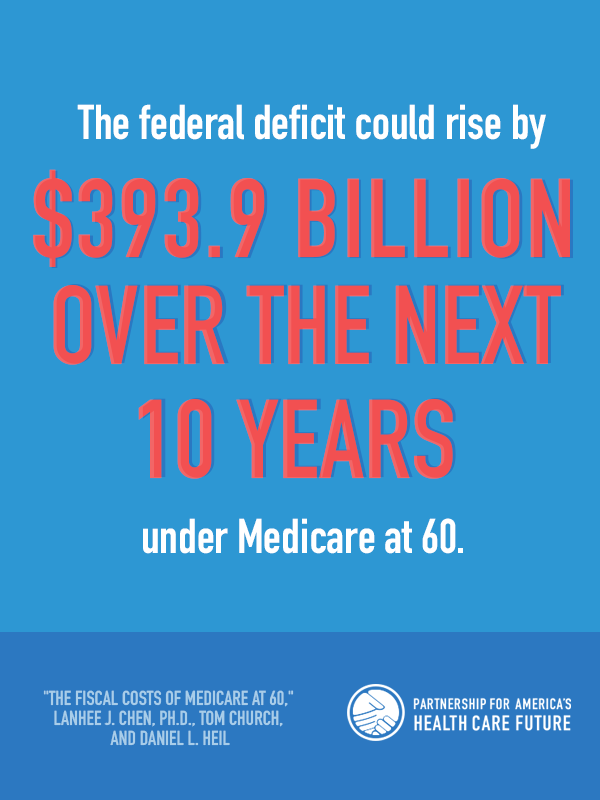

The report by Lanhee J. Chen, Ph.D., Tom Church and Daniel L. Heil, which was supported by the Partnership for America’s Health Care Future, finds that under “Medicare at 60,” gross Medicare expenditures could rise by $82.9 billion in 2022 while the federal deficit could rise by $32.2 billion in 2022 and $393.9 billion over the next ten years.

In addition to potential tax increases needed to pay for “Medicare at 60,” the report’s authors warn of a number of other potential consequences, including:

Creating Unaffordable New Costs, Tax Increases, & Higher Deficits

- To finance “Medicare at 60,”Congress could pursue various tax increases.

- Congress could raise the additional Medicare tax rate by 285 percent in 2022, setting it at 3.5 percent in addition to the 2.9 percent for the standard Medicare payroll tax.

- Congress could also raise the standard Hospital Insurance (HI) tax, which would impact many more Americans. In 2022, the tax rate would need to be 3.25 percent—a 12 percent increase in the current rate.

- Enrolling in Medicare could result in high costs for 60-64-year-olds that could otherwise be avoided in the current health care system.

- 1.3 million individuals that would qualify for “Medicare at 60” are currently covered by a plan on the current marketplaces. Nearly 70 percent of this group currently receive subsidies and could end up paying more after transitioning to Medicare, particularly those with incomes above 135 percent of the poverty line, who would be required to pay Part B and Part D premiums.

- 17 percent of the newly eligible population could owe income-related premiums. This is far higher than the 7.7 percent share among existing Medicare recipients.

- In addition to Medicare premiums potentially costing more than plans from the Marketplace, the new Medicare plans could have higher cost-sharing requirements and add increased costs to families that are split between Medicare and Marketplace plans.

- Already, Medicare is the second-largest single line item in the federal budget, it will soon surpass Social Security and grow more quickly than every other component. Under “Medicare at 60,” gross Medicare expenditures would rise by $82.9 billion in 2022 and total Medicare spending could rise by $995 billion over 10 years.

- Overall, the federal deficit would rise by $32.2 billion in 2022 and $393.9 billion over the next 10 years (2022 to 2031).

- Absent alternative financing mechanisms, the Hospital Insurance (HI) Trust Fund would be depleted in 2024, two years sooner than currently projected.

Threatening Access To Quality Health Care

- “Medicare at 60” could negatively affect hospitals and medical providers that are already financially strained by reducing the reimbursement rates they receive. These potentially unsustainable cuts could mean lower quality and less access to care for the current Medicare-eligible population.

Additional Risks To Affordability & Access

- “Medicare at 60” eligible Americans covered by Medicaid or employer sponsored insurance could owe new Medicare premiums while seeing few novel benefits from their Medicare enrollment. In many cases, these individuals could be required to enroll in Medicare or risk losing their retiree health benefits.

- Medicare does not provide coverage to dependents that do not otherwise qualify for coverage, and over 15 percent of the “Medicare at 60” population have children under 26 living in their households — compared to seven percent of 65–69-year-olds. Policyholders of family plans could be unlikely to enroll in Medicare if it results in the loss of coverage for other family members.

- Currently, automatic Medicare enrollment for Parts A and B are only available to those receiving Social Security benefits. Among the 60- to 64-year-old population, only 17.5 percent report Social Security enrollment. This has implications for enrollment as well as broader fiscal policy.

- Lowering the eligibility age could affect labor markets if it induces some individuals to retire earlier. This could result in lower tax revenue, further straining the federal budget. A recipient’s decision to retire early could also increase Social Security outlays.

At the same time, our current health care system is working to expand access to affordable, high-quality health coverage and care. A new report from the U.S. Department of Health and Human Services (HHS) reveals that nearly 31 million Americans have gained coverage under current law in 2021.