April 2022 Recess Toolkit

Key Talking Points

- The most effective way to expand access to affordable, high-quality health coverage and care is to build on what’s working in health care – not to create an unaffordable, new government-controlled health insurance system such as the public option or by opening up senior’s Medicare to younger Americans.

- Increased subsidies have helped a record number of Americans gain access to coverage when they needed it most.

- Building on our current system has led to the rate of Americans without health insurance dropping to a near historic low.

- As Congress breaks and lawmakers look ahead to the midterm elections in November, building on and improving what’s working in health care is the future of health care reform that lawmakers should continue to focus on.

- Of the fourteen Senate Democrats running for re-election in 2022, only one supports Medicare for All and no Democratic candidate running for the open Senate seats supports Medicare for All. The 2022 candidates instead are focusing on building on what’s working in our current system.

- Because government-controlled health insurance systems are unaffordable and complicated, there has been no movement by the Biden administration to include creating one in its agenda.

Public Option

- The public option could come with unaffordable new costs for working Americans.

- The public option could harm the existing health care insurance system and cause premium increases for currently insured Americans, force a reduction in coverage options, and reduce access to care for seniors and low-income families. (Congressional Budget Office, 4/21)

- The public option could have significant impacts on America’s future fiscal condition and either increase the federal debt or require higher taxes on American families. (Lanhee J. Chen, Ph.D., Tom Church, and Daniel L. Heil, 2/3/21)

- In fact, the public option could be even more expensive for working families than originally projected.

- A public option could add $700 billion to the federal deficit in its first 10 years and would become the third most expensive government program behind Medicare and Social Security, both of which are already at risk for the seniors that rely on them. (Lanhee J. Chen, Ph.D., Tom Church and Daniel L. Heil, 1/24/20)

- Research found that under the public option the average American family could eventually see their payroll taxes increase by more than $2,500 a year and 10-year deficits could increase by $800 billion due to the public health crisis. (Lanhee J. Chen, Ph.D., Tom Church and Daniel L. Heil, 10/20/20)

- Over 30 years, a public option could lead to a new 4.8 percent payroll tax or marginal tax rate increases for most American families to finance the new program. (Lanhee J. Chen, Ph.D., Tom Church and Daniel L. Heil, 1/24/20)

- Creating the public option could harm patients’ access to the affordable, high-quality health care they need and deserve – including among vulnerable rural and minority communities.

- The public option could put a $774 billion financial strain on hospitals over a 10-year period, potentially forcing hospitals to reduce staff and eliminate services as they operate on a negative profit margin due to lower reimbursement rates. (KNG Health Consulting, 3/12/19)

- The closure of hospitals could decrease access to care in rural communities. A public option could put one in four rural hospitals at an increased risk of financial distress and in many of these communities, these hospitals are the only source of health care. (FTI Consulting, 7/14/21)

- Reductions in private payment rates may make it more difficult for rural hospitals to hire additional physicians or other health care professionals in areas already facing shortages of such workers. (Urban Institute, 3/21)

- The public option could force health care providers to shorten appointment times, make staffing changes, or eliminate services in order to remain financially viable. This would diminish access to essential health care services for patients. (FTI Consulting, 7/14/21)

- The negative impact of the public option on hospitals could also harm communities where racial and ethnic minority patients are overrepresented and often rely on hospitals for their health care. Many of the hospitals already at risk for closure serve predominantly minority communities who could be left without a health care provider, especially in southwestern United States. (FTI Consulting, 7/14/21)

- The hospitals most at risk under the public option admitted more children and non-Hispanic Asian or Pacific Islander patients as a share of total admissions than hospitals with lower ratios of private to total charges. (Urban Institute, 3/21)

- Relative to specialized Medicaid managed care plans that prioritize care coordination and address social determinants of health, the public option may not provide the coverage necessary to meet the unique health care needs of at-risk, low-income populations. (FTI Consulting, 7/14/21)

- Creating the public option could cause “significant disruptions” and “result in only a modest decrease in the number of uninsured persons compared to how many people would gain coverage through leveraging the public/private framework that exists under current law.” (KNG Health Consulting, 3/12/19)

- Overall, the public option could drastically alter the current health care market. It could drive an estimated 60 million people (40 percent of the market) out of employer-sponsored insurance which could potentially eliminate the entire private exchange market. (FTI Consulting, 5/21)

- A public option would force up to two million Americans off their current coverage and leave eight million Americans without a private coverage option. (FTI Consulting, 11/19/19)

Medicare at 60

- Opening up seniors’ Medicare to younger Americans through proposals like “Medicare at 60” could come with higher costs, worse quality of care, and an unaffordable price tag.

- To finance Medicare at 60, Congress could pursue various tax increases. This includes raising the additional Medicare tax rate by 285 percent or raising the standard Hospital Insurance (HI) tax rate by up to 12 percent in 2022. (Lanhee J. Chen, Ph.D., Tom Church and Daniel L. Heil, 6/23/21)

- Enrolling in Medicare could result in high costs for 60-64-year-olds that could otherwise be avoided in the current health care system. (Lanhee J. Chen, Ph.D., Tom Church and Daniel L. Heil, 6/23/21)

- Nearly 70 percent of this group currently receive subsidies and could end up paying more after transitioning to Medicare, particularly those with incomes above 135 percent of the poverty line.

- New Medicare plans could have higher cost-sharing requirements and add increased costs to families that are split between Medicare and Marketplace plans.

- “Medicare at 60” could negatively affect hospitals and medical providers that are already financially strained by reducing the reimbursement rates they receive. These potentially unsustainable cuts could mean lower quality and less access to care for the current Medicare-eligible population. (Lanhee J. Chen, Ph.D., Tom Church and Daniel L. Heil, 6/23/21)

- Already, Medicare is the second-largest single line item in the federal budget; it will soon surpass Social Security and grow more quickly than every other component. Under “Medicare at 60,” gross Medicare expenditures could rise by $82.9 billion in 2022 and total Medicare spending could rise by $995 billion over 10 years. (Lanhee J. Chen, Ph.D., Tom Church and Daniel L. Heil, 6/23/21)

- Overall, the federal deficit could rise by $32.2 billion in 2022 and $393.9 billion over the next 10 years (2022 to 2031). (Lanhee J. Chen, Ph.D., Tom Church and Daniel L. Heil, 6/23/21)

- Absent alternative financing mechanisms, the Hospital Insurance (HI) Trust Fund would be depleted in 2024, two years sooner than currently projected. (Lanhee J. Chen, Ph.D., Tom Church and Daniel L. Heil, 6/23/21)

Government-Controlled Health Insurance Systems’ Poor Track Records

- California’s latest proposal for single-payer health care in 2022 failed due to the proposal’s high cost of $222 billion per year. (Los Angeles Times, 1/12/22)

- California’s previous single-payer proposal in 2017, which was estimated to cost $400 billion a year, could not pass in the state. (Cal Matters, 8/16/21)

- Vermont lawmakers attempted to pass single-payer health care in 2011 but abandoned this plan due to high costs. (Health Affairs, 12/19/18)

- In Washington, the state public option remains unpopular and unaffordable.

Build on what’s working in health care

- We could cover more Americans by making enhancements to current law permanent and expanding Medicaid in the 12 states which have not yet done so – without the costs and negative consequences caused by creating the public option. (FTI Consulting, 5/21)

- At present, Americans in the Medicaid coverage gap (2.2 million people) are defined as adults who live in states that have not expanded Medicaid whose incomes are above their state’s eligibility for Medicaid but, below the federal poverty line, the minimum income eligibility for tax credits through the health insurance marketplaces. (KFF, 1/21)

- This disproportionately affects communities of color. Roughly 60 percent of Americans who don’t have access to Medicaid coverage are people of color. (CBPP, 6/21)

- At present, Americans in the Medicaid coverage gap (2.2 million people) are defined as adults who live in states that have not expanded Medicaid whose incomes are above their state’s eligibility for Medicaid but, below the federal poverty line, the minimum income eligibility for tax credits through the health insurance marketplaces. (KFF, 1/21)

- Improvements to current law are already helping to lower costs for Americans and making these enhancements permanent could improve affordability.

- The number of individuals eligible for a subsidy to purchase Marketplace coverage has increased 20 percent from 18.1 million to 21.8 million. The majority of uninsured people (63 percent) are now eligible for financial assistance through the Marketplaces, Medicaid, or Basic Health Plans. (Kaiser Family Foundation, 3/25/21)

- Most of the people eligible for these subsidies (84 percent) have incomes below 400 percent of the Federal Poverty Level (FPL), but now 11 percent of people have incomes between 400-600 percent of the FPL (up to an income of $76,560 for a single individual or $157,200 for a family of four). (Kaiser Family Foundation, 3/25/21)

- Four out of 10 uninsured people are already eligible for a free or nearly free health care plan under existing law. (Kaiser Family Foundation, 3/25/21)

- 3.2 million Americans selected a plan for $10 or less per month after the additional subsidies provided by the American Rescue Plan. (Department of Health & Human Services, 01/27/22)

- Expanded Premium Tax Credits have reduced monthly premiums for new enrollees by an average of 25 percent. Americans have been able to sign up for health insurance plans that have lower out-of-pocket maximums with the mean deductible for new consumers falling by nearly 90 percent. (Centers for Medicare & Medicaid Services, 5/6/21)

- The number of individuals eligible for a subsidy to purchase Marketplace coverage has increased 20 percent from 18.1 million to 21.8 million. The majority of uninsured people (63 percent) are now eligible for financial assistance through the Marketplaces, Medicaid, or Basic Health Plans. (Kaiser Family Foundation, 3/25/21)

- Existing public and private programs are working together to expand access to affordable, high-quality health coverage and care. Enhancements to the Affordable Care Act in the past year have resulted in tremendous progress with regard to both access and affordability.

- Since the ACA’s introduction, adult uninsured rates and racial and ethnic coverage inequities declined in nearly every state, particularly in states that built on what’s working by expanding Medicaid eligibility. (The Commonwealth Fund, 6/9/21)

- Nearly 31 million Americans have enrolled in Affordable Care Act (ACA) Market plans as of early 2021. (The Washington Post, 6/5/21)

- During the Open Enrollment Period from November 1, 2021 through January 15, 2022, 5.8 million people gained new coverage under our current system. (Department of Health & Human Services, 01/27/22)

- This would bring the total of Americans enrolled in ACA coverage to a record-high of nearly 37 million.

- The Department of Health & Human Services released new enrollment reports showing that a record-high 14.5 million Americans enrolled in Affordable Care Act (ACA) coverage during the last Open Enrollment Period. (Department of Health & Human Services, 01/27/22)

- The American Rescue Plan lowered health care costs for most Marketplace consumers and increased enrollment to these records levels: Americans saw their average monthly premium fall by 23%, compared to the 2021 enrollment period that ended before the American Rescue Plan passed. (Department of Health & Human Services, 01/27/22)

- The current health care system has lowered adult uninsured rates and reduced racial and ethnic coverage inequities in almost every state over the past decade. (The Commonwealth Fund, 6/9/21)

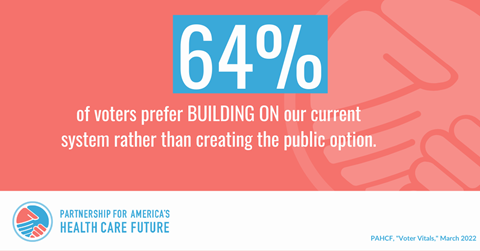

- Recent polling shows that shows that lowering costs remains the top health care priority for voters of all parties – especially in a time of high inflation. The vast majority of voters – including Democrats – prefer for lawmakers to build on our current health care system rather than create the public option or open up Medicare to younger Americans. Most are unwilling to pay any more in taxes or health care costs to create a new government-controlled health insurance system. (Voter Vitals, 3/17/22)

- Lowering COSTS (63 percent) remains the top health care priority for Democratic, swing, and Republican voters.

- 64 percent of voters prefer BUILDING ON our current system rather than creating the public option, and 66 percent prefer building on our current system instead of opening up Medicare.

- Voters still prefer to build on what’s WORKING by providing subsidies for those in states that did not expand Medicaid to purchase coverage in the existing marketplace (57 percent) over creating a new government-run insurance plan (43 percent).

- The vast majority of voters remain CONCERNED about the access, cost, and long-term fiscal impacts of creating the public option or opening up Medicare.

###

Sample Social Media

64 percent of voters prefer BUILDING ON our current system rather than creating the public option, and 66 percent prefer building on our current system instead of opening up seniors’ Medicare. Learn more: https://bit.ly/3Khkhfz

DYK: Implementing a public option could force millions of Americans off their current plans and lead to higher health care costs. Learn the real costs of the public option: https://bit.ly/3gATJsi

Strengthening our current health care system could expand access to affordable, high-quality health care coverage more than the public option. Learn more: https://bit.ly/39PQDgV

Our latest #VoterVitals polling shows that the vast majority of voters remain concerned about the access, cost, and long-term fiscal impacts of creating the public option or opening up Medicare. Learn more: https://bit.ly/3Khkhfz

Building on what’s working in health care, where private coverage, Medicare, and Medicaid work together, has helped a record number of Americans gain access to affordable, high-quality health care coverage over the past 12 years. Learn more: https://bit.ly/3JaUBQ9

What could proposals like Medicare at 60 mean for you and what you pay for health care? It could increase taxes and limit access to quality care. Learn the real costs of proposals like Medicare at 60: https://bit.ly/3ESVBYy

Our current health care system has already helped 31 million Americans get health care coverage. Let’s keep building on what’s working in health care. Learn more: https://bit.ly/3rBuTxt

Why start from scratch with unaffordable, government-controlled health insurance systems like the public option when most Americans support building on what’s already working? Learn more: https://bit.ly/3Khkhfz

Our latest polling shows that the vast majority of voters remain CONCERNED about the access, cost, and long-term fiscal impacts of creating the public option or opening up Medicare. Learn more: https://bit.ly/3Khkhfz

With Medicare for All, Americans could see their payroll taxes triple or all other taxes more than double. Learn the real costs of Medicare for All: https://bit.ly/3Dlk205

Did you know that opening up seniors’ Medicare to younger Americans could bankrupt the Medicare trust fund by 2024? Learn the real consequences of proposals like Medicare at 60: https://bit.ly/3IORrl4