Medicare At 60 Could Lead To Higher Costs For Americans

As some policymakers discuss proposals such as “Medicare at 60,” which would open seniors’ Medicare up to younger Americans, a new report provides additional evidence of the potentially unaffordable costs and negative consequences.

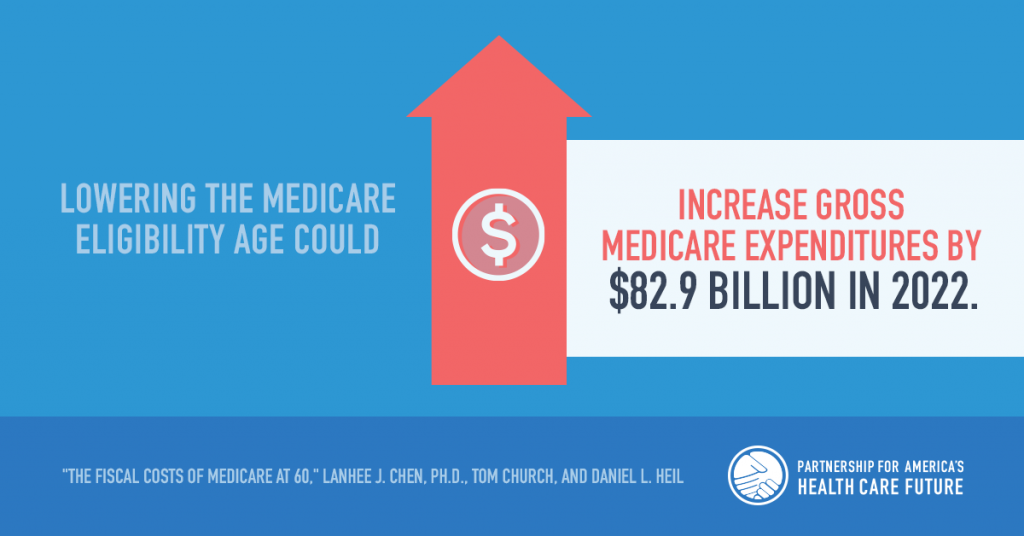

The report by Lanhee J. Chen, Ph.D., Tom Church and Daniel L. Heil, which was supported by the Partnership for America’s Health Care Future, finds that under “Medicare at 60,” gross Medicare expenditures could rise by $82.9 billion in 2022 while the federal deficit could rise by $32.2 billion in 2022 and $393.9 billion over the next ten years. And financing “Medicare at 60” could require tax increases on Americans.

THE FACTS:

- Financing “Medicare at 60,” could require tax increases.

- Under “Medicare at 60,” gross Medicare expenditures would rise by $82.9 billion in 2022 and total Medicare spending could rise by $995 billion over 10 years.

- Overall, the federal deficit would rise by $32.2 billion in 2022 and $393.9 billion over the next 10 years (2022 to 2031).

- Absent alternative financing mechanisms, the Hospital Insurance (HI) Trust Fund would be depleted in 2024, two years sooner than currently projected.

- “Medicare at 60” could negatively affect hospitals and medical providers that are already financially strained by reducing the reimbursement rates they receive. These potentially unsustainable cuts could mean lower quality and less access to care for the current Medicare-eligible population.

- “Medicare at 60” eligible Americans covered by Medicaid or employer sponsored insurance could owe new Medicare premiums while seeing few novel benefits from their Medicare enrollment. In many cases, these individuals could be required to enroll in Medicare or risk losing their retiree health benefits.

- Lowering the eligibility age could affect labor markets if it induces some individuals to retire earlier. This could result in lower tax revenue, further straining the federal budget. A recipient’s decision to retire early could also increase Social Security outlays.

THE TRUTH:

One-size-fits-all, new government health insurance systems like Medicare at 60, Medicare for All, or the public option could come with high costs and negative, unintended consequences. Our leaders need to focus on solutions that build on and improve what’s working in health care, not start over.