What Are These Proposals?

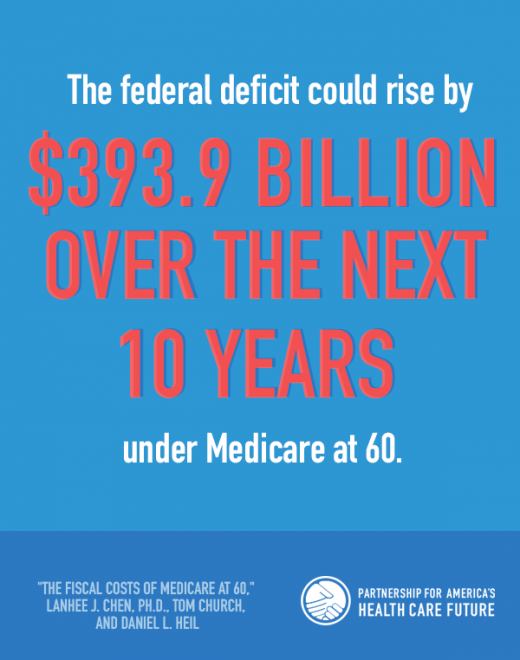

- Medicare expansion proposals, such as “Medicare buy-in” and “Medicare At 60,” would expand Medicare to allow for tens of millions more Americans to get coverage through the Medicare program.

- Medicare buy-in would allow younger Americans to purchase health insurance coverage through Medicare.

- Medicare at 60 would allow Americans to become eligible for Medicare coverage at age 60 instead of at age 65.

What Are The Risks?

Unaffordable: Higher Taxes and Health Care Costs for Those with Private Coverage

Millions of seniors and future generations of Americans are relying on Medicare to be strong, stable and secure for the future. However, adding tens of millions of Americans to Medicare today would increase costs and threaten to overwhelm the program. We simply can’t afford higher taxes or benefit cuts to expand Medicare.

In a story titled “How a Medicare Buy-In or Public Option Could Threaten Obamacare,” The New York Times reports that “a government buy-in that attracted older Americans could indeed raise premiums for those who remained in the A.C.A. markets, especially if those consumers had high medical costs,” and “a government plan that attracted people with expensive conditions could prove costly.”

Threatens Access to Quality of Care for Seniors

Medicare expansion programs like Medicare buy-in would threaten access to quality care that senior citizens rely on. By allowing tens of millions of Americans to buy into Medicare, seniors could have less access and have to wait longer for their doctors and care. And when costs increase, benefits could be cut to save money. Let’s protect the coverage and care our seniors rely on – not put it up for sale.

Instead, we should build on and improve what’s working in health care, where private coverage works together with Medicare and Medicaid to expand access to affordable, high-quality health coverage and care.

Insolvent: Existing Medicare Program Is Already Financially at Risk

Medicare was created to meet the needs of a specific population, our seniors. This program and its benefit structure were not created for larger, more diverse patient populations. Expanding Medicare to a broader patient population through a buy-in or a lower eligibility age would threaten the program for those currently enrolled and future generations who are relying on it being there when they need it.

America’s seniors have paid into Medicare their whole working lives and have waited to join the program, which was designed to provide older Americans with quality coverage and care. However, Medicare’s trustees are warning that the program is already at risk for today’s seniors, with part of the program projected to be bankrupt in just five years.

As the Kaiser Family Foundation (KFF) reports, “[t]he solvency of the Medicare Hospital Insurance trust fund, out of which Part A benefits are paid, is a common way of measuring Medicare’s financial status,” and in the “the 2020 Medicare Trustees report, the actuaries projected that assets in the Part A trust fund will be depleted in 2026, just five years from now.” KFF also notes that a “more recent projection from the Congressional Budget Office also estimated depletion of the HI trust fund in 2026.”

Unfortunately, Medicare’s at-risk status is not new. A 2019 report from Medicare’s trustees painted a picture of its future described in news reports as “troubled,” “shaky,” “grim” and “sobering,” leading The Wall Street Journal to report that the “projections suggest the [program’s funding] problem could affect not only future retirees, but also current ones. Today’s newest retirees will be 72 when Medicare’s hospital trust fund is depleted … said Maya MacGuineas, the president of the Committee for a Responsible Federal Budget. ‘That fact that we now can’t guarantee full benefits to current retirees is completely unacceptable…’”

What They Are Saying: Stepping Stone to Medicare for All, Ineffective, and Financially Strains the Medicare Program

- The Wall Street Journal reports that new government health insurance systems like Medicare buy-in and the public option represent “stepping stones to single payer,” commonly known as Medicare for All.

- “Lowering Medicare’s eligibility age is unnecessary, given that older adults are more likely to have insurance than any other age group. It would also put more financial stress on the entitlement, which is dangerously close to insolvency,” writes the Pacific Research Institute’s Sally Pipes in Forbes. “Covid-19 has only accelerated this march to insolvency … Lowering Medicare’s eligibility age would result in millions of people exiting private coverage and picking up new public coverage at taxpayer expense.”

Today, our health care system is working together to expand access to affordable, high-quality health coverage and care, and a recent analysis by the Kaiser Family Foundation (KFF) finds that “the number of people eligible for a subsidy to purchase Marketplace coverage has increased 20 percent from 18.1 million to 21.8 million with passage of” the American Rescue Plan Act (ARPA), while “the majority of uninsured people (63 percent) are now eligible for financial assistance through the Marketplaces, Medicaid, or Basic Health Plans. In fact, more than four out of 10 uninsured people are eligible for a free or nearly free health plan through one of these programs.”

The Associated Press reports that ARPA represents “the biggest expansion of federal help for health insurance since the Obama-era Affordable Care Act,” and separate steps are already underway to extend open enrollment in the federal health care marketplace, eliminate ineffective red tape that can prevent Americans from accessing coverage options and urge the Supreme Court to uphold the Affordable Care Act.

At a time when our health care system is working together to help Americans get healthy and stay healthy, the time has never been better to build on and improve what’s working – where private coverage, Medicare and Medicaid work together to expand access to coverage and care – in order to lower costs, protect patient choice, expand access, improve quality and foster innovation.